Estate Tax Exclusion 2025 - Client ($27,980,000.00 for a u.s. This exclusion allows taxpayers to gift assets to. Historical Estate Tax Exemption Amounts And Tax Rates, For married couples, this amount effectively.

Client ($27,980,000.00 for a u.s. This exclusion allows taxpayers to gift assets to.

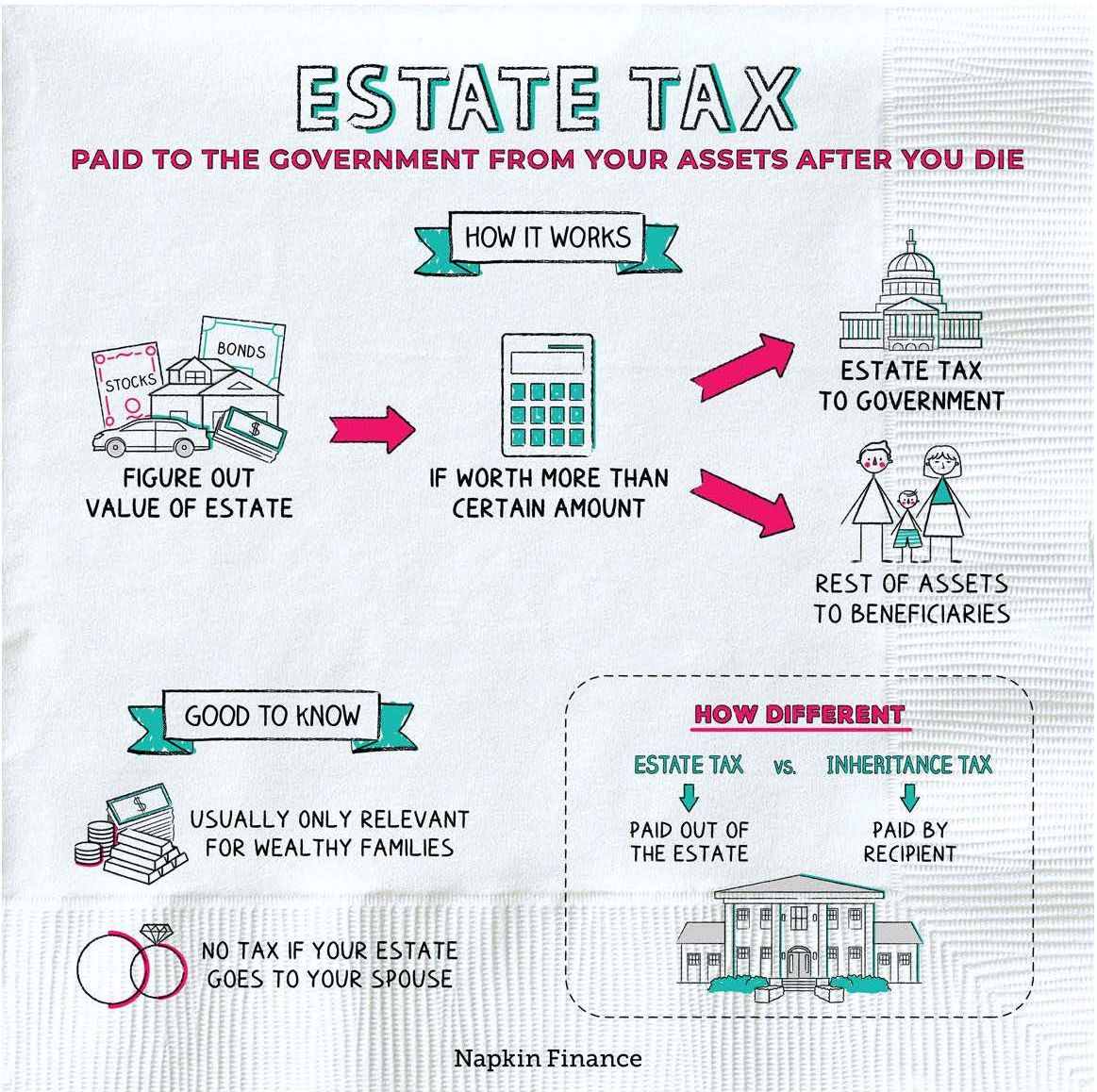

Estate Tax Exclusion 2025. With the increase to $13.99 million in 2025, individuals can transfer more wealth to their heirs without incurring federal estate taxes. Starting january 1, 2025, the federal lifetime gift, estate, and gst tax exemption amount will increase to $13,990,000 per person or.

Are You Prepared for the 2025 Federal Estate Tax Exclusion Limit Sunset, The net gain is typically calculated as the sale price minus the.

Estate Tax Exemption 2025 Married Couple Gabie Jocelyn, In addition, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2025.

Estate Tax Exemption 2025 Paige Barbabra, With a key exemption scheduled to be sharply cut after 2025, the window to make large gifts to your heirs may close soon.

Nba All Star Lineup 2025. Freshman (18) stats (as of 12/10/24):. 1 pick in the 2026 nba draft, announced his...

Phil Groundhog 2025. Punxsutawney phil is a superstar prognosticating groundhog from punxsutawney, pennsylvania. What you need to know as punxsutawney...

California Estate Tax Exemption 2025 Gretel Analiese, Here are the new numbers and considerations for 2025:

Toby Mac Concert 2025. It will have you on your feet, singing your heart out and experiencing the power of...

The Federal Estate Tax Exemption 2025 And Beyond List of Disney, For married couples filing jointly, the standard deduction rises to $30,000.

Gift Tax Exemption 2025 Understanding The Lifetime Exclusion And Its, If congress doesn't act, the estate tax exemption will sunset at the end of 2025.