Tax Return Deadline 2025 For California Residents - Tax Filing Deadline California 2025 Leah Sharon, When’s the deadline in 2025? That's the day taxes are due for most taxpayers. Press Release Format 2025. Free press release templates and examples for success in 2025. How […]

Tax Filing Deadline California 2025 Leah Sharon, When’s the deadline in 2025? That's the day taxes are due for most taxpayers.

Tax Return Deadline 2025 For California Residents. Story by cortlynn stark, the sum, the sacramento bee • 1w. What you need to know:

Usps Rate Increase January 2025. These proposed prices were approved by the postal service governors […]

The IRS Tax Refund Schedule 2023 Where's My Refund?, Story by cortlynn stark, the sum, the sacramento bee • 1w. Individuals and businesses with their principal residence or place of business in san diego county will have until june 17, 2025, to file certain california individual and business.

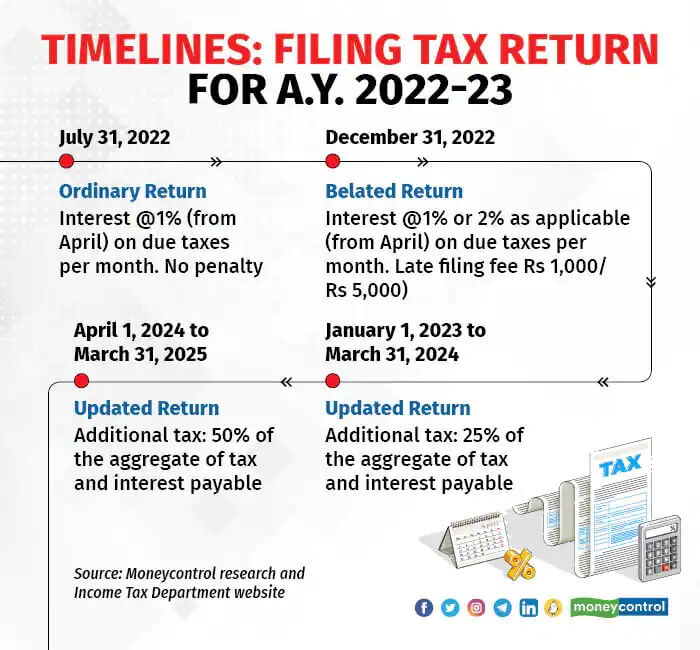

Irs Tax Filing 2025 Viva Alverta, Tax day 2025 is april 15. In january, citing the winter storms that led to federal emergency and disaster declarations, the internal revenue service postponed the due date for most.

When Can I File Taxes 2025 Date Deadline Netti Adriaens, Tax day is coming in less than two weeks, so don't hold off any longer on getting your taxes filed. 21, 2025, through june 17, 2025.

2025 Tax Season Calendar For 2023 Filings and IRS Refund Schedule, Tax day is monday, april 15, 2025. The last day to file a tax return with the irs is monday, april 15 for the vast majority of americans.

However, california grants an automatic extension until.

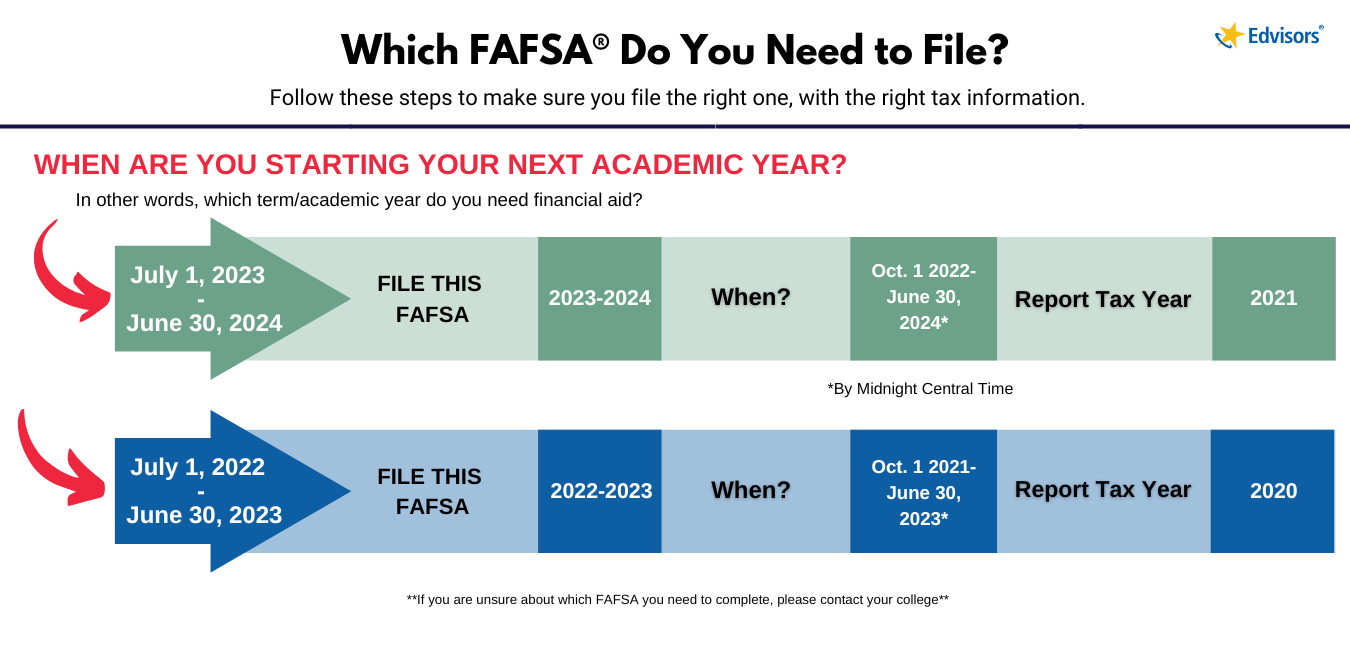

What Is The Deadline For Fafsa 2025 Kira Randee, The tax relief postpones various tax filing and payment deadlines that occurred from jan. Newsom, irs give californians until october to file tax returns.

California’s state franchise tax board received 4.5 million personal.

The extended deadlines vary by state, but the feb.15, 2025, tax deadline extension applies to quarterly estimated income tax payments normally due on sept. What you need to know: